Here are the things to be kept in mind while filing income tax return forms: Individual taxpayers have a deadline of July 31 each year, while businesses and other entities have a deadline that varies depending on their category.Īlso Read | Confused about old and new income tax regime? Here's a dedicated calculator (Representative Image)Īlso Read | Income Tax Return: What is ITR-1 or Sahaj ? Who is eligible to file?įirms or corporations, Hindu Undivided Families (HUFs), and self-employed or salaried individuals are required to file an ITR with the Income Tax Department of India. Penalties range from Rs.1,000 to Rs.10,000 if their returns are filed after the due date. It is also used as proof of income when applying for loans, visas, or other financial transactions. Individuals and entities whose income exceeds the exemption limit set by the Income Tax Department must file an ITR.

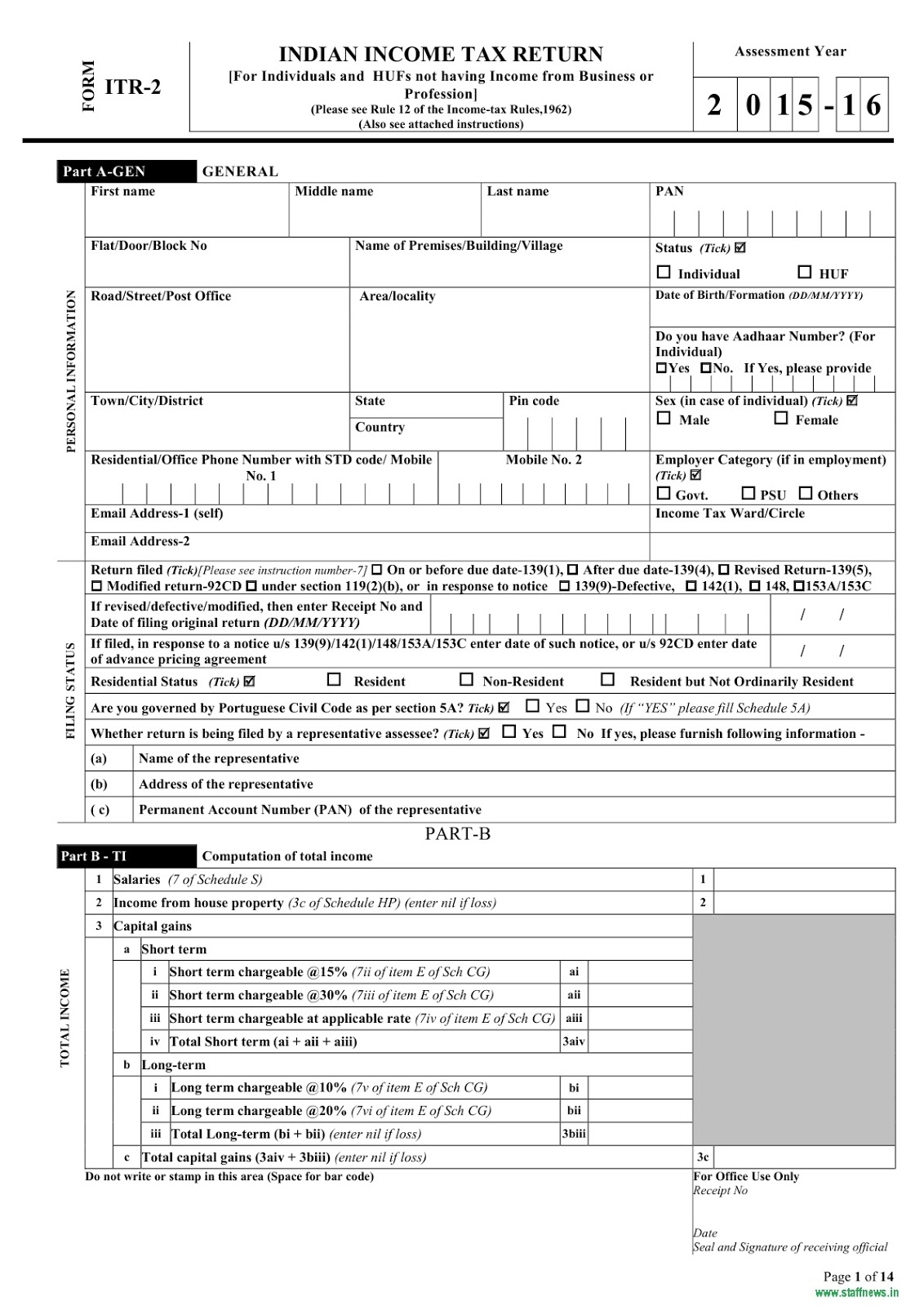

Income Tax Returns (ITRs), are forms used to declare net tax liability, claim tax deductions, and report gross taxable income.

0 kommentar(er)

0 kommentar(er)